IRS and Treasury Launch Direct File Now, free online filing platform that cuts out the middleman, no hidden fees to file taxes

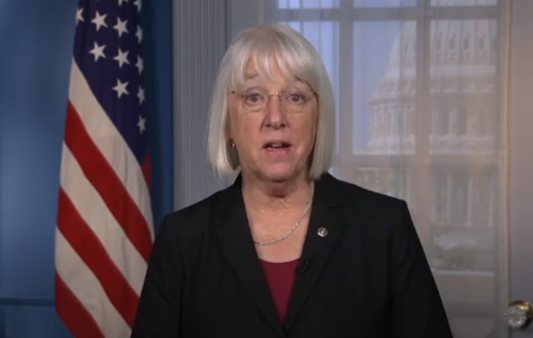

The Treasury Departments estimates that 1.1 million Washington state taxpayers will be eligible; VIDEO of Senator Murray announcing Direct File Pilot

Senator Murray: “Democrats made a worthwhile investment in the IRS to help ensure giant corporations and the very wealthiest would pay at least the taxes they already owe—part of that investment also means a more efficient IRS that can provide better services and create tools like Direct File that will save people money.”

Washington, D.C. – Today, U.S. Senator Patty Murray (D-WA), Chair of the Senate Appropriations Committee, announced the launch of the U.S. Department of the Treasury’s and Internal Revenue Service’s (IRS) new Direct File Pilot Program, including a new Spanish version of the free tax filing service. Direct File is a new IRS service that allows eligible taxpayers to prepare and file their tax return online, for free, directly with the IRS, rather than going through a middleman website and shelling out hundreds of dollars.

Direct File was made possible by the Inflation Reduction Act, landmark legislation Senator Murray was instrumental in passing, which invested new resources in the IRS to allow the agency to provide world class service to taxpayers, including by developing new tools like Direct File that make it easier for Americans to file their taxes. The Treasury Departments estimates that 1.1 million Washington state taxpayers will be eligible. This investment will also reduce the deficit by ensuring wealthy individuals, large corporations, and complex partnerships pay taxes owed.

WATCH: Senator Murray Announces Launch of New Direct File Pilot Program

“Americans should not have to shell out hundreds of dollars just to file their taxes,” said Senator Murray. “Taxpayers should be able to file their taxes directly with the IRS through a secure, free platform, and today, it’s finally becoming a reality. Democrats made a worthwhile investment in the IRS to help ensure giant corporations and the very wealthiest would pay at least the taxes they already owe—part of that investment also means a more efficient IRS that can provide better services and create tools like Direct File that will save people money. I encourage all Washington state taxpayers to check if they are eligible and file their taxes with Direct File before April 15th.”

Direct File provides a free, secure option for taxpayers with simple tax situations in 12 states to file their taxes directly with the IRS, including for Washington state. Direct File is easy to use, with no hidden junk fees, and works as well on a smartphone as it does on a laptop, tablet, or desktop computer. Direct File shows taxpayers the math so they can be sure that their return is accurate, and they are getting the refund they are entitled to. Live customer service support is also available for Direct File users. Initial users have saved hundreds of dollars and reported that the tool is simple and straightforward to use.

Examples of taxpayers who may be eligible to use Direct File this Filing Season include:

- A parent with W-2 income that claims the Earned Income Tax Credit and Child Tax Credit.

- A recent graduate with W-2 income, who pays student loan interest.

- A retired senior citizen with Social Security income.

###