ICYMI: Senator Murray Pushes for Passage of SAFE Banking Act

ICYMI: Senator Murray Introduces Legislation to Decriminalize Cannabis at the Federal Level

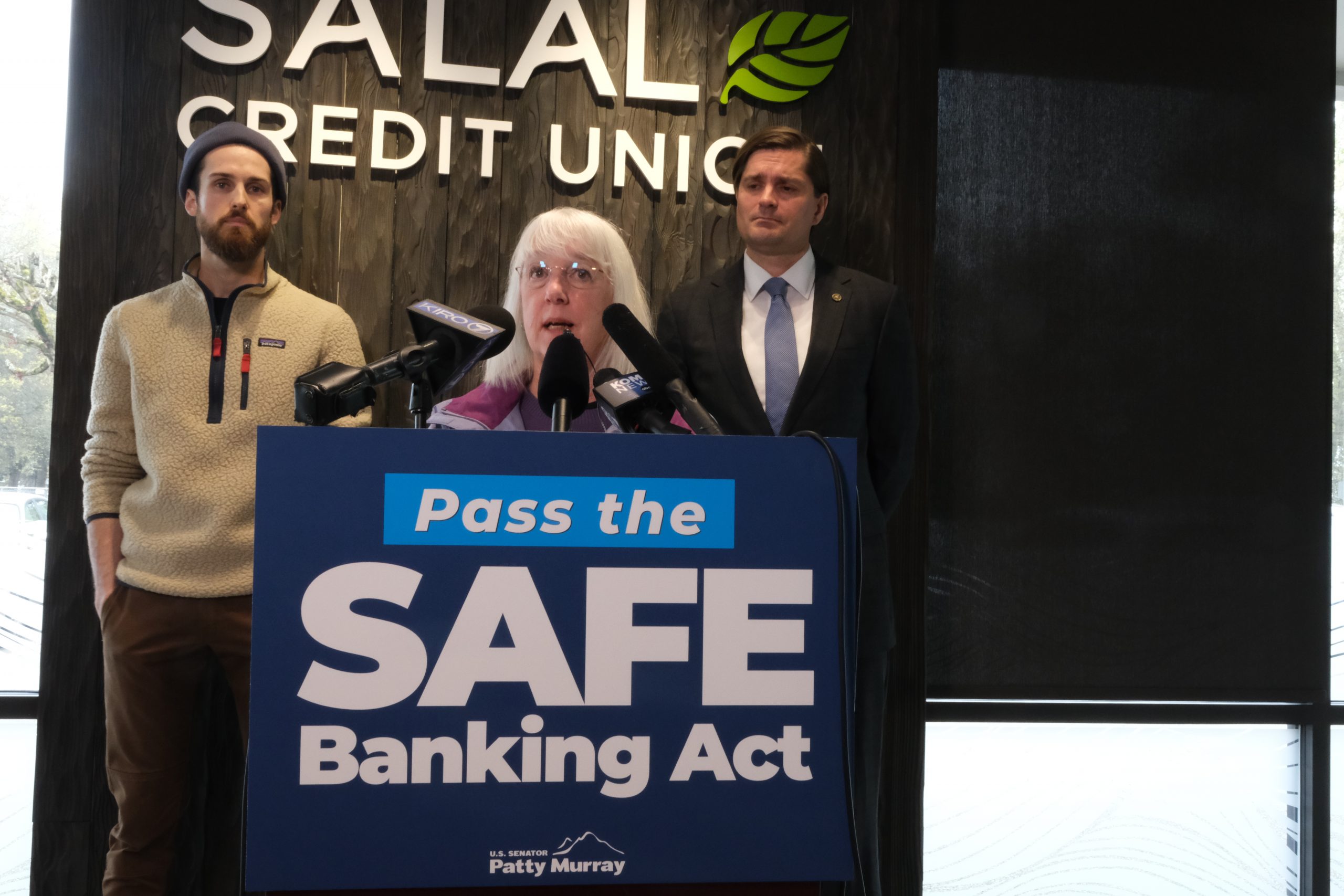

Washington, D.C. – U.S. Senator Patty Murray (D-WA), Chair of the Senate Appropriations Committee, joined U.S. Senators Jeff Merkley (D-OR), Steve Daines (R-MT), and U.S. Representatives Dave Joyce (R-OH-14) and Earl Blumenauer (D-OR-03) this week to introduce the bipartisan, bicameral Secure and Fair Enforcement (SAFE) Banking Act of 2023. The bill would ensure that legal cannabis businesses would have access to critical banking and financial services.

Most state-legal medicinal or recreational cannabis businesses are denied access to traditional and secure banking systems and financial services because banks fear they may be prosecuted under federal law given the ongoing federal restrictions on cannabis. Due to the lack of access to financial services, state-legal cannabis businesses are forced to operate their businesses solely using cash. This reality doesn’t just open the door to potential tax evasion, but it also increases the potential for criminal activity.

“It makes absolutely no sense that legal cannabis businesses in states like Washington are forced to operate entirely in cash—and it’s dangerous to their employees, their businesses, and our neighborhoods,” said Senator Murray. “This bipartisan legislation would bring legal cannabis businesses into the formal banking system, where they belong—making our communities safer and providing much-needed relief to these small businesses and their customers. Let’s make this the Congress where we finally pass this legislation into law—and let’s get it done as soon as possible.”

The SAFE Banking Act of 2023 would prevent federal banking regulators from:

- Prohibiting, penalizing or discouraging a bank from providing financial services to a legitimate state-sanctioned and regulated cannabis business, or an associated business (such as a lawyer or landlord providing services to a legal cannabis business);

- Terminating or limiting a bank’s federal deposit insurance primarily because the bank is providing services to a state-sanctioned cannabis business or associated business;

- Recommending or incentivizing a bank to halt or downgrade providing any kind of banking services to these businesses; or

- Taking any action on a loan to an owner or operator of a cannabis-related business.

This legislation would also create a safe harbor from criminal prosecution and liability and asset forfeiture for banks and their officers and employees who provide financial services to legitimate, state-sanctioned cannabis businesses—while maintaining banks’ right to choose not to offer those services. The bill would also provide protections for hemp and hemp-derived cannabidiol (CBD) related businesses. This legislation, for the first time, explicitly extends the safe harbor to Community Development Financial Institutions (CDFI) and Minority Depository Institutions (MDI) to ensure they can also serve cannabis businesses. CDFI and MDI serve underserved communities who face challenges in accessing capital and provide affordable access to financial services.

The SAFE Banking Act would require banks to comply with current Financial Crimes Enforcement Network (FinCEN) guidance, while at the same time allowing FinCEN guidance to be streamlined over time as states and the federal government adapt to legalized medicinal and recreational cannabis policies.

The SAFE Banking Act has passed the House seven times with strong bipartisan support.

The legislation is cosponsored by U.S. Senators Jacky Rosen (D-NV), Bill Cassidy (R-LA), Kirsten Gillibrand (D-NY), Cynthia Lummis (R-WY), Brian Schatz (D-HI), Lisa Murkowski (R-AK), Edward J. Markey (D-MA), Kevin Cramer (R-ND), Ben Ray Luján (D-NM), Dan Sullivan (R-AK), Catherine Cortez Masto (D-NV), Rand Paul (R-KY), Angus King (I-ME), Tammy Duckworth (D-IL), John Fetterman (D-PA), Ron Wyden (D-OR), Kyrsten Sinema (I-AZ), Alex Padilla (D-CA), Dick Durbin (D-IL), Peter Welch (D-VT), MarkKelly (D-AZ), Michael Bennet (D-CO), Tina Smith (D-MN), Amy Klobuchar (D-MN), Elizabeth Warren (D-MA), Tim Kaine (D-VA), Debbie Stabenow (D-MI), Bernie Sanders (I-VT), Bob Menendez (D-NJ), Chris Coons (D-DE), John Tester (D-MT), Mark Warner (D-VA), Martin Heinrich (D-NM), John Hickenlooper (D-CO), Mazie Hirono (D-HI), Gary Peters (D-MI), and Chris Murphy (D-CT), and U.S. Representatives Warren Davidson (R-OH-08), Jim Himes (D-CT-04), Brian Mast (R-FL-21), Barbara Lee (D-CA-12), Guy Reschenthaler (R-PA-14), Nydia Velázquez (D-NY-07), Lori Chavez-DeRemer (R-OR-05), and Lou Correa (D-CA-46).

Bill text can be found here.

###