Members write in letter: “We believe that the IRS can offer free and easy tax filing to every American taxpayer who wants it—and that, with Direct File, it will.”

13,954 taxpayers in Washington state filed their federal tax returns using Direct File this year

Taxpayers gave Direct File rave reviews, with 90 percent rating their experience positively and 86 percent saying it increased their trust in the IRS

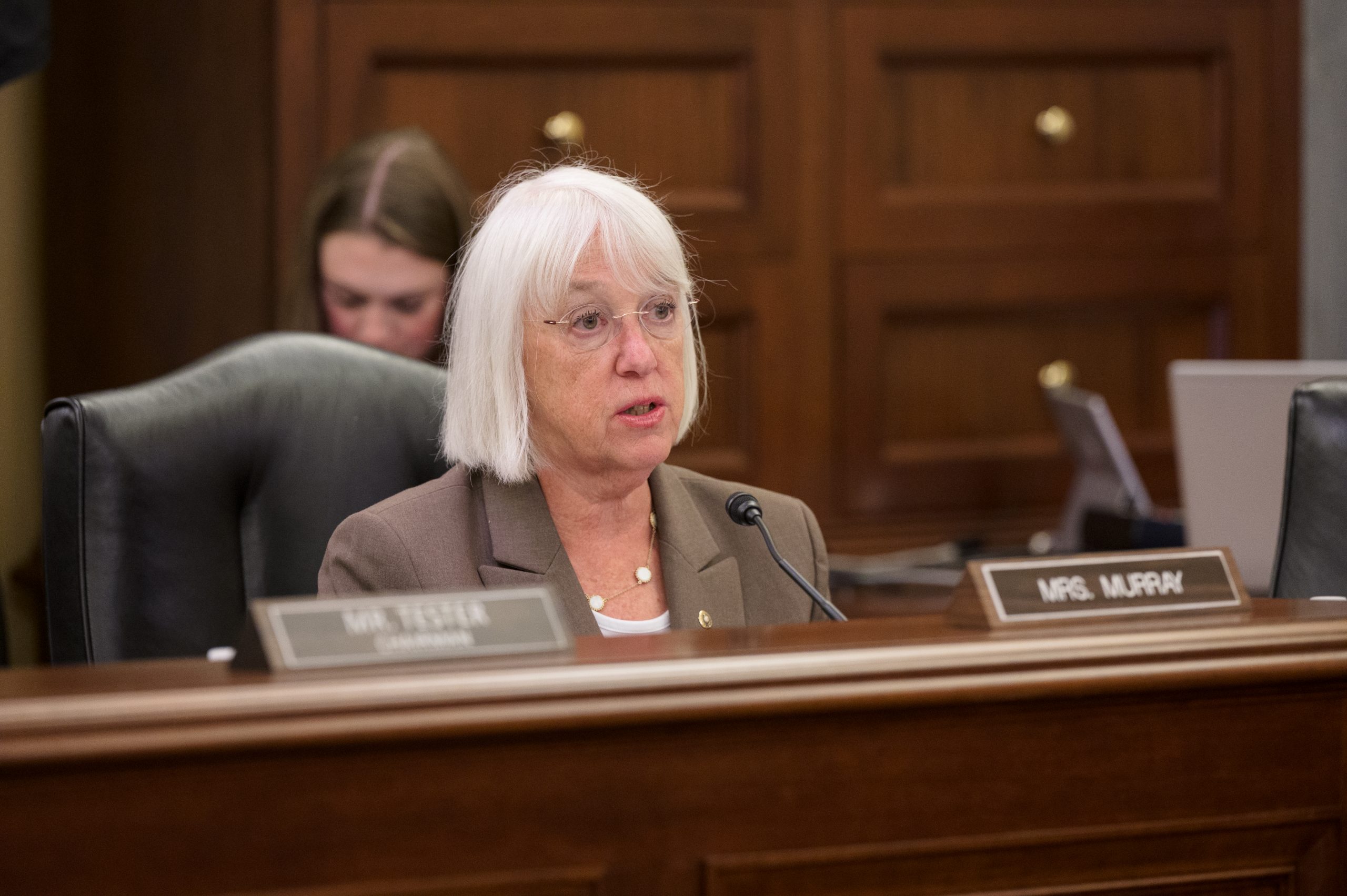

ICYMI: As Tax Filing Season Ends, Senator Murray Highlights Successes of Direct File Pilot in Washington State

Washington, D.C. — Today, U.S. Senator Patty Murray (D-WA) joined Senators Elizabeth Warren (D-MA) and Tom Carper (D-DE), and U.S Representatives Don Beyer (D-VA-08), Katie Porter (D-CA-47) and Brad Sherman (D-CA-32) and over 130 lawmakers in sending a letter to U.S. Secretary of the Treasury Janet Yellen and Internal Revenue Service (IRS) Commissioner Daniel Werfel, applauding the successful pilot of the Direct File program, and urging them to make it permanent and expand its functionality and scope. The letter follows the conclusion of the 2024 tax season and implementation of the IRS Direct File program in 12 pilot states, including Massachusetts, which allowed taxpayers to file their returns for free, directly with the IRS.

“We write to commend you on the historic and resoundingly successful launch of Direct File, the first free, public, electronic federal tax filing tool in U.S. history. Taxpayers want and deserve a free and easy filing option, and thanks to this year’s pilot, taxpayers used Direct File to claim over $90 million in tax refunds and save $5.6 million in estimated filing fees,” said the lawmakers. “We applaud your leadership and Direct File’s incredible success this year, and we call on you to make Direct File a permanent program, expanding it and improving it further next year and in the years to come.”

The Biden administration announced in May of last year that they would be launching a Direct File pilot in 2024. This past tax season, over 140,000 taxpayers used the tool across 12 pilot states, saving taxpayers more than $90 million in refunds and an estimated $5.6 million in tax preparation fees on their federal returns alone. A survey of 11,000 users found that 90 percent ranked their experience with Direct File as “Excellent” or “Above Average,” and 90 percent of survey respondents who used customer service similarly found the experience “Excellent” or “Above Average.”

“The IRS’s delivery of this new, wildly successful filing tool… demonstrates the huge returns from investing in the IRS and in government technology in general,” continued the lawmakers. “We hope Direct File will support additional sources of income, integrate with more states, offer more flexible identity verification procedures, and accommodate additional tax benefits, with a focus on refundable credits available to low- and middle-income families. Direct File should also continue streamlining the filing process by using taxpayer data that the IRS already has.”

“We congratulate you on the success of the Direct File pilot and stand ready to work with you on making the program permanent and expanding it. We believe that the IRS can offer free and easy tax filing to every American taxpayer who wants it — and that, with Direct File, it will,” concluded the lawmakers.

The full text of the letter and full list of signatories from the Senate and House is HERE.

Direct File was made possible by the Inflation Reduction Act, landmark legislation Senator Murray helped pass in 2022 as then-Assistant Majority Leader. The Inflation Reduction Act invested new resources in the IRS to allow the agency to provide world class service to taxpayers, including by developing new tools like Direct File that make it easier for Americans to file their taxes. This investment in the IRS will also reduce the deficit by ensuring wealthy individuals, large corporations, and complex partnerships pay taxes owed. Last June, Murray signed onto a letter to Commissioner Werfel and Deputy Treasury Secretary Adewale Adeyemo expressing support for the Direct File pilot and urging IRS to make a strong tool available to as many taxpayers as feasible in 2024. Murray announced the launch of Direct File in March of this year and highlighted the successes of direct file in Washington state in April.

Earlier this week, more than 250 groups sent a letter to Commissioner Werfel and Secretary Yellen also encouraging them to make Direct File permanent and expand it.

###